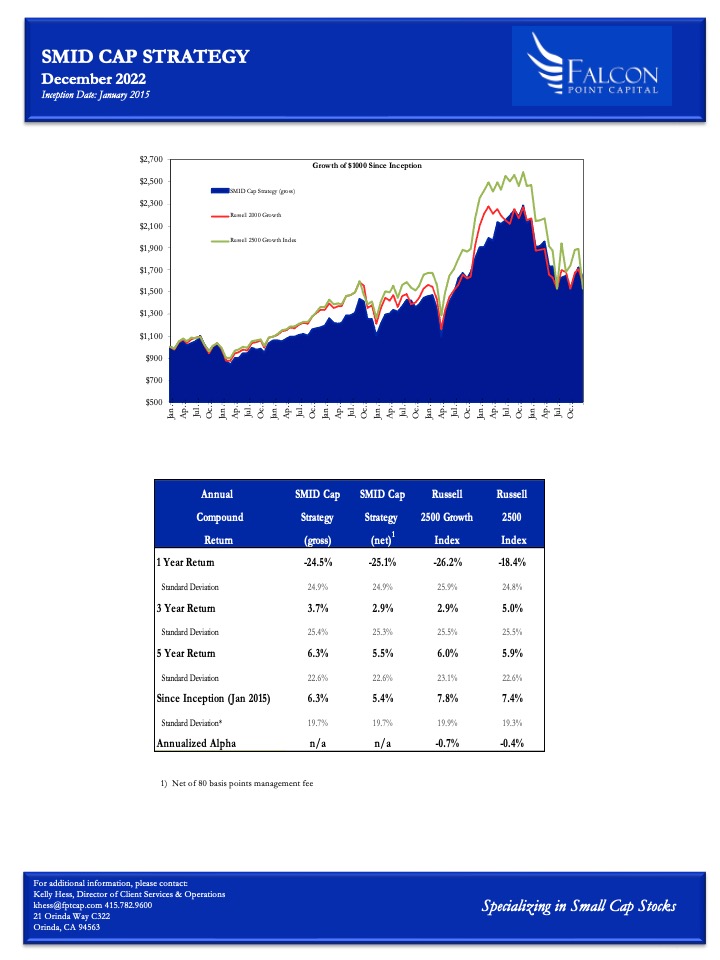

The SMID Cap Strategy is a long only, SMID cap strategy designed to outperform the Russell 2500 Index. The investment team employs detailed fundamental analysis to build a diversified portfolio of approximately 30-50 stocks. The team seeks to identify companies that are able to combine sustainable, above average revenue growth with expanding margins and increasing returns on invested capital. We buy these stocks at valuation levels that provide the potential for 25%+ returns over the strategy's expected 12-18 month holding period. We believe that the combination of strong fundamental research and a disciplined approach to valuation provides the opportunity for above average risk-adjusted returns over the course of time.

All of Falcon Point Capital strategies accept separately managed accounts. Below is the strategy performance which includes one or more separate accounts. No single investors performance will exactly match the strategy performance. Please see the disclosure page for additional information.